Many people that are fans of Jobs-to-be-Done don’t really understand that much about how the data is collected, used to spot value gaps, or more importantly, take advantage of that knowledge to identify ways to accelerate organic growth in these special market perspectives. It’s not their fault. No one wants you to know!

In this post, I’m going to talk about a set of basic models for growth pathways that can be derived from the data, and the sizing of those moves (the size of the impact in market percentage as well as dollar size).

My goal is to help you visualize this without dumping piles of data in your lap. Most of you are not data scientists, and neither am I. However, we all do need to get comfortable with understanding what properly organized and analyzed data can do for us. To that end, you should try to learn a teeny weeny little bit about data analysis.

I’ll save that for another post.

Starting at the Top

Ultimately, I’d like to present this data as a visual dashboard in a BI tool (a standardized version is being developed). The difference between my concept and most dashboards is that we’ll be going into this with a Jobs-to-be-Done foundation. That means we should leverage something that looks similar to the Jobs-to-be-Done prioritization framework as the visual foundation - at least at the top level (for job mapping studies).

Some dashboards are focused on operating data, so you’d expect indicators to change - numbers, percentages, colors - as data that’s being tracked changes in real-, or near real-time. With our dashboard concept, we’ve taken a snapshot in time so that’s not what we expect (just like any survey).

However, when constructed properly, a Jobs-to-be-Done value model that is prioritized with a properly constructed survey, will take scores of snapshots, from different angles, at a single moment. This allows us to manually change the perspective - much like editing videos from a modern 360 degree action camera.

Please keep in mind, this is a high-level discussion. I will be getting deeper into the details of what should drive these moves in my Masterclass at some point.

A Quick Conversation About Taking Shortcuts

We are constantly under pressure to take action, drive results, generate demand, innovate, right?

The problem is that most leaders make these demands but don’t really show you how do it. They went to the same seminars you did, took the same online courses you did, participated in the same workshops you did. And what’s been the result?

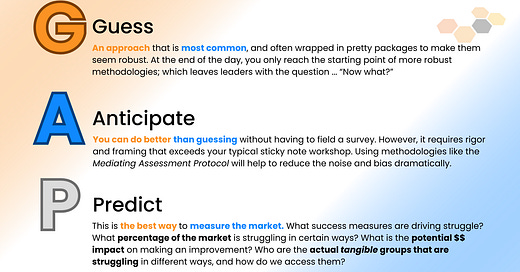

Let’s talk about the 3 levels of Jobs-to-be-Done research that are practiced out there. There is a huge disparity between them …

I call this the GAP.

95% of the JTBD practitioners out there are in the “G” category, I’m sad to say. They come armed with things that look cool and have a highly polished performance. You’ve heard me talk about systems before. These are not systems people, they are individual performers. They are not reproducible, not scalable, and their results - while pretty - are not reliable.

They are facilitating guesswork.

The next category is something a few practitioners toy with. This is a more structured (systems thinking) way of trying to get the most value out of qualitative research. Let’s face it, an investment in JTBD (ODI-type) research is beyond the means of 99% of the enterprises that are competing for growth. And even that top 1% is squealing incessantly about cost and time.

Is there something that can be done to make qualitative research more valuable, more predictable than mere guesswork? Possibly … as long as you understand the limitations.

While there are ways to reduce noise and bias (from our internally-derived opinions) they really won’t provide the precision you want when making critical financial investment decisions. But, given that we can now frame the problem-space in a matter of hours instead of weeks, you can make the case that in mere days you can have something that far exceeds the outcomes you get from the guessing approach.

You’re still guessing, you’ve just put a more structured approach that strives to eliminate bias and noise to an imperfect process

Finally, there is a category that maybe 1% of the practitioners out there even understand beyond a few books and articles that obfuscate what’s really going on. This is where real science is taking place, both with customers (customer science) and with the method itself (continually being tested and improved 👈🏻).

The only way to dramatically increase confidence in your strategy is to develop data that inspires it. And that can only come from the people who are actually impacted by the problem-space … end users, customers, consumers, purchase decisions-makers, etc.

While nothing can be 100% accurate, the level of accuracy and dimensionality of proper JTBD research is currently second to none, and outperforms the other categories by miles.

My colleagues and I are working frantically to reduce the time and complexity of Predict so you can realize the outcomes faster, and less expensively. This is a theme I’m sure you’re seeing in similar competencies like marketing where they are already trying to eliminate real survey respondents with synthetic ones (they’ll still gouge you).

No one is taking a nap here. All of this work is going to be simpler, and you won’t need to understand the mechanics of real Jobs-to-be-Done, just how to take the insights and formulate and test appropriate strategies that help you grow consistently over time.

Okay, maybe not so quick. Sorry.

Where Most Practitioners End, We’re Just Beginning

You’ve all seen job maps before. Well, maybe. Some of you may have only seen some job stories that are conflated shortcuts to insights.

The key point here is that if you have a product, or are developing a new product, your focus is always on execution of some kind. We have traditionally created steps for our maps that are essentially a process. But I’d like you to think of them as jobs - or mini jobs. While your product may address the before, during, and after of the phases within one of the mini jobs, there is a higher level of abstraction that you are not looking at…because you can’t see it.

This is where your growth comes from because over time, solutions organically emerge that address these definitions of a market completely. Focus solely on features in your mini job at your peril.

As you can see below, there are a lot of other mini jobs that your customers are trying to get done in conjunction with using your solution. The more you can identify them, and help with them, the more value your platform be perceived as delivering.

Because, at the end of the day, your customers are cobbling together solutions from a variety of other brands, or personal effort, to get these things done. I realize this isn’t as sexy as plugging AI into your existing product - everyone else is going to so you should do it too, right?

WRONG

Adding features with no explicit purpose is a waste of your time and resources and customers generally don’t value added cost and complexity that doesn’t help them get the true job done. They just can’t tell you what that is because, like you …

… they are focused on your product

Your job is to eliminate that innovation constraint.

Simplifying the Problem-Space for Discussion Purposes

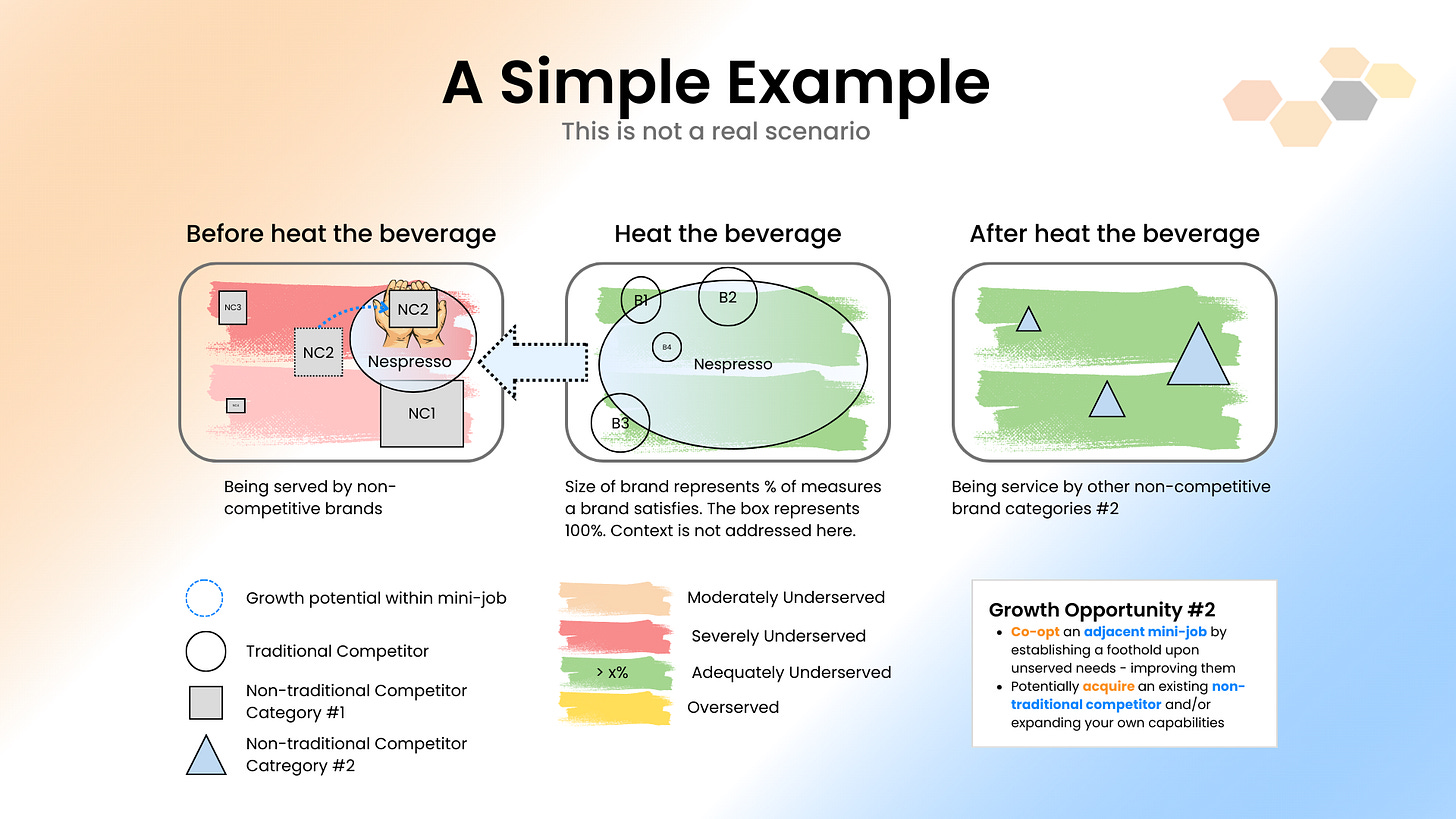

Let’s reduce this overbearing job map to a simple 3-step process. Just like a story, there is a beginning, a middle, and an end. In this case, a consumer is heating a beverage, but there are things they do before, during, and after.

These things are often invisible to most product strategy teams because they are focused on their existing product. In reality, there are opportunities all over the place, and what we call non-traditional competitors that are trying to address them.

Sometimes they address them well (see the right box) and sometimes not so well (see the left box).

The First Thing Data Can Help You Understand

Using the Anticipation, or Predict approaches you’ll be able to see areas within your current mini job where the people purchasing (or could be purchasing) your product are satisfied, struggling, or burdened.

Collecting and analyzing real performance data (customer success measures) within these mini jobs will show you precisely where to:

eliminate features (or pipeline) that add cost or complexity

do nothing, because people are adequately served

add features that address measures, or sets of measures that add quantifiable value (assuming the development or acquisition of these is within your means in the target term)

Figure 4 shows how a brand co-exists with other direct competitors within a mini job. But, with the knowledge they get with predictive research, that can see exactly where and how to expand their value contribution … taking ground from the competition.

The beauty of having the appropriate data is the you are not guessing at what people are struggling with and how much they would value something that helps them resolve the struggle.

Without data, sizing this opportunity is a fools-errand

The Second Thing Data Can Help You Understand

While many of these mini strategies can be executed simultaneously, I’m showing this stepwise so as not to complicate.

Once you have squeezed all of the value-producing features out of your current execution (mini job) focus, you can look to the backend or the frontend of the market for additional opportunities.

Note: my observation is that most of the new value will be on frontend of the market, where all the planning and resource allocation happens

In Figure 5 you will see that the brand has addressed all of the value gaps in the execution phase (now green) of the larger Job-to-be-Done and is now co-opting value an adjacent space. In this case the first (and possibly best) opportunity is a mini job that is expressing severe underservedness through the data (that no one else has, by the way).

This leaves the focal brand with a couple of options:

expand the current platform (or portfolio) to incorporate features that address some of the measures that are expressing a struggle (I won’t tell you how to prioritize that in this post)

acquire a non-traditional competitor and integrate it into your platform

a combination of both

The goal is clearly to help customers get more of their job done (not yours) on a single platform. An example might be to integrate more components of the process into a single piece of hardware so people don’t need to juggle a bunch of different tools or products.

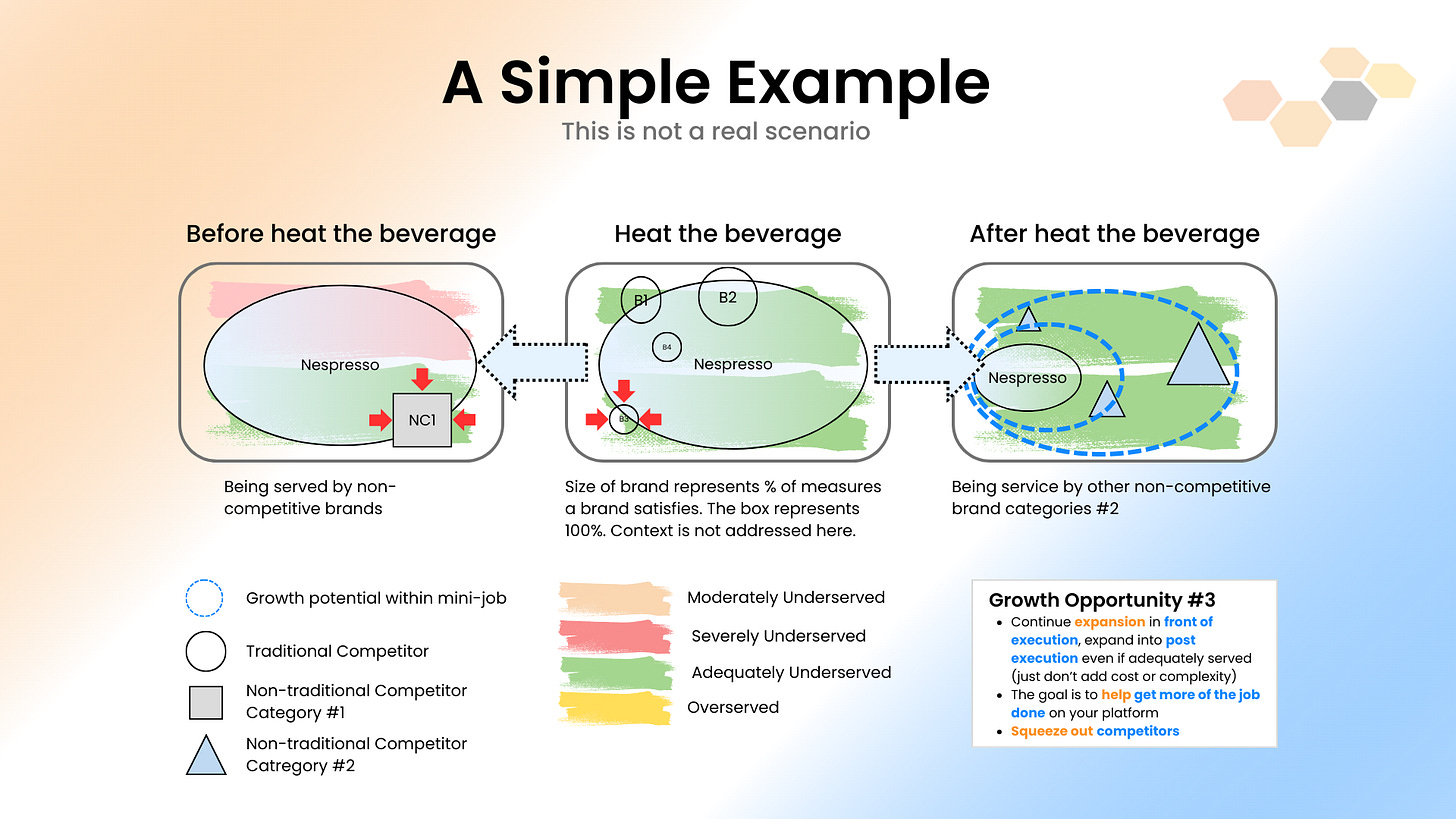

The Third Thing Data Can Help You Understand

Of course, once you have begun the march into adjacencies, your goal is to expand within them.

In Figure 6 you will see that the focal brand has expanded into the before space and knocked out some of the original non-traditional competitors, while stealing share from others. This comes from an asymmetry of insights that you can get - with predictability - from the right kind of data.

Guessing may help - just like it helps with the lottery!

At this time, you can also look into areas that appear to be adequately served.

Should you rush in and add new features above and beyond what non-traditional competitors are offering? Only if you think overserving the market makes sense … which it doesn’t!

The value to you and your customers is simply going to be from helping them get more of their job done on a single platform. An example might be when Google adding a parking locator to their Maps and Waze platforms. Did they need to add more features than all of the parking app startups out there?

No, simply adding the feature wiped those companies out. Quickly!

I plan to go a few levels deeper into this in the future. You can watch it unfold in my community, or in my Masterclass subscription.

Wait until you see the dashboard!

If you'd like to learn more...

I do offer end-to-end consulting if you’re just not ready to do it all your own. I’m 20x faster and at least 10x cheaper than your alternatives. Big Brands: This means you can get many more problems solved with your existing budget (I work with a global team of experienced practitioners)

I also offer coaching, if you’d like to know someone’s got your back and you want to do the heavy lifting and get some knowledge transfer, I'm there!

I can help you get your qualitative research done in 2 days for mere budget scraps.

I’ve also got a JTBD Masterclass where you can find evolving and expanding and much deeper content for a do-it-yourself experience. It includes portfolio of AI prompts that eliminates the pain of learning how to perform proper qualitative JTBD research. And these capabilities continue to grow.

Finally, I've recently opened up a JTBD community that is completely FREE! It's still early days and it's where I work with clients - in private spaces - and where I hang out to answer questions or just blather on. I hope you'll join us! There will be more and more free stuff, and there will also be some premium stuff eventually. I wonder what that will be?