Framing the Discussion

What I’m going to suggest below will be anathema to the hoards of Venture Capitalists out there - young and old. I am certainly an iconoclast on this topic, if not a heretic. I also have a strange sense of humor.

So be it!

However, what I’m going to suggest is something that I believe should be embraced by an industry that is known for it’s abysmal track record at predicting breakthrough innovations, while using other peoples’ money to place poorly thought-out bets.

PLEASE! Do not cherry pick some success story from a well-known brand and retrofit it into your 10 point evaluation framework. Let’s focus on the 10s of thousands of failures that were also invested in. I'm about to propose a method to drastically reduce the number of poorly thought-out investments. 😉

I’m not sure how small firms can afford to play this game. Iterative experimentation is a luxury reserved for industry titans. With their established reputations, privileged access to prime opportunities, and deep pockets, these firms can afford to cast a wide net and weather numerous setbacks in their pursuit of success. Can small firms spread their investments that broadly and have similar success?

Doubtful.

The large firms are handed the best opportunities because, maybe, one or more of their partners were successful once and therefore everyone assumes they will be successful again.

By the way … how do you define success? I often wonder what happens to startups when the founder cashes out. The founder’s success is not success.

So, this is for the little guy who wants to build valuable companies and not just cash out and leave the future to someone else. Firms that have a limited amount of funding and resources and can't afford to spread it across 60 potential successes to see which one (if any) hits. It’s simply not a practical approach to investing. For anyone. Ever.

If you disagree, please leave a comment below, with sauce. I’m sure everyone will be interested, including me.

What Am I Suggesting?

Let me get right to the point. Everyone loves to talk about Product-Market Fit like it’s some kind of panacea for successful startup investing. If you’re waiting until you reach this milestone to determine your likelihood of success, then you will always have a portfolio of losers to contend with.

Everyone has a portfolio of losers.

I’m going to suggest a better way to gain Potential Market Fit up front, so you can place bets with a solid understanding of market need and size, and can assess your capability to deliver (or the capability of your portfolio company) on the needs you know are faced frequently, are extremely important, and take a crap load of effort to satisfy by potential end users.

It’s one thing to (precisely) understand customer needs (which most of you don’t, sorry) and it’s another to understand whether you can gain access to the required capabilities to deliver the required value. Both are necessary to be successful. Both must be evaluated earlier, as opposed to using lagging indicators after a significant investment is consumed.

And another very important consideration is to understand this at a level of abstraction that is both differentiated (the problem is framed, and solved completely differently) and achievable (utilizes long-standing or emergent resources that don't need to be invented), even if it involves concepts that you had never before considered when looking at the elementary school formulas, and rules of thumb, commonly regurgitated in the VC industry, and on social media by VC wannabees.

No, I'm not a VC. 🤣

The Bottom Line

Product launch success rates are as low as ever.

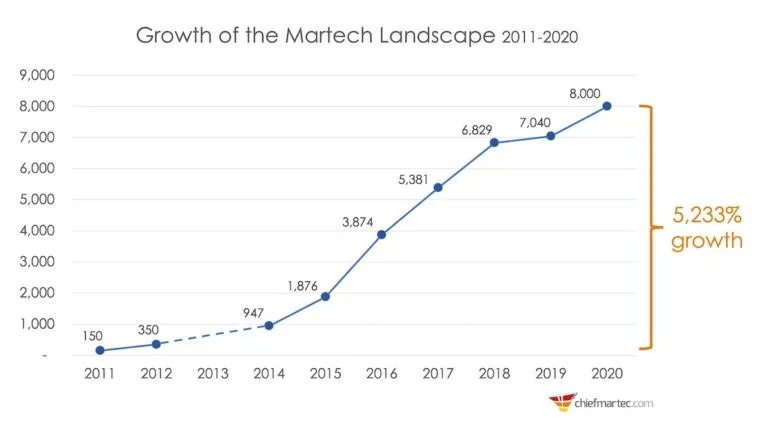

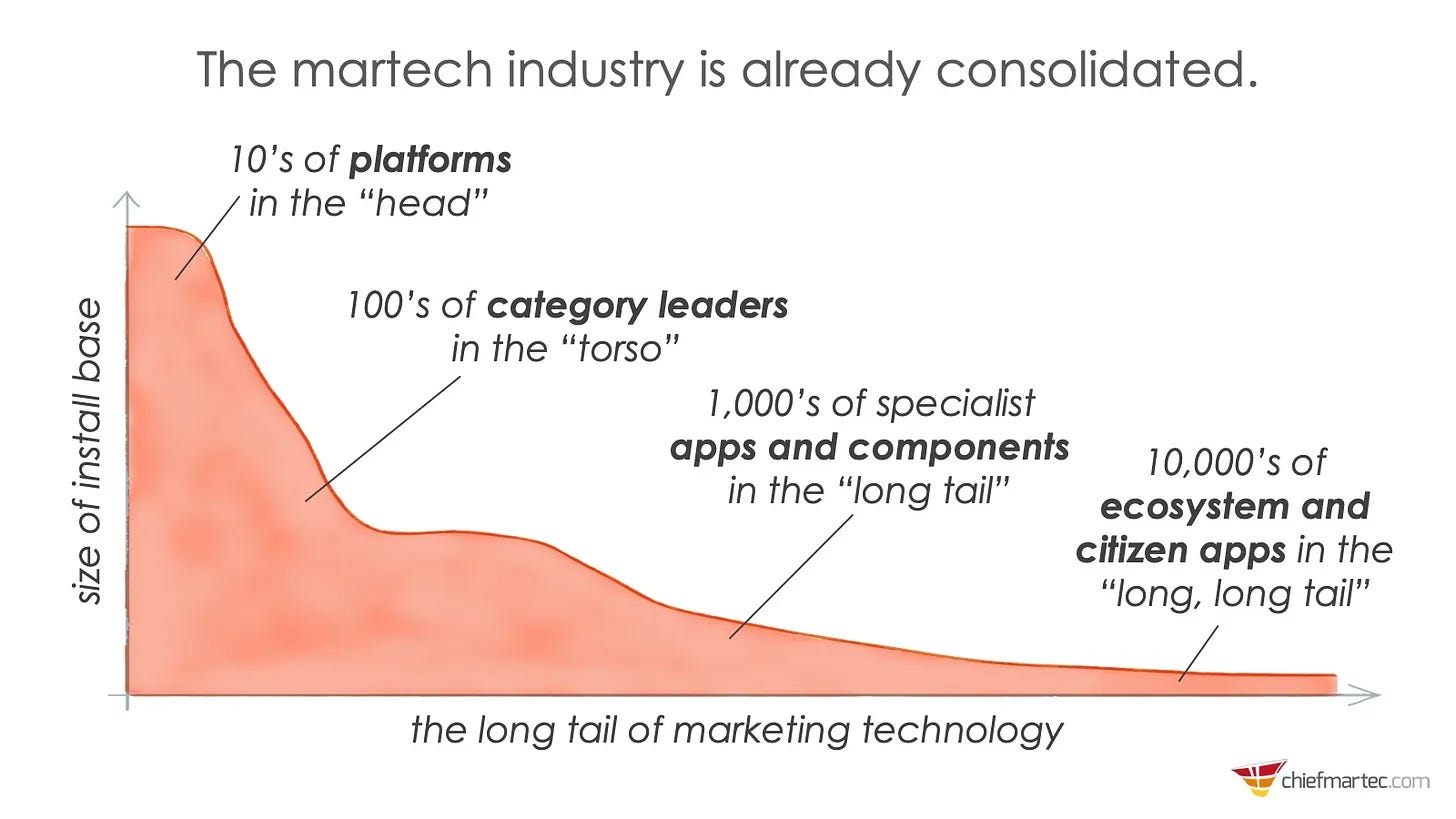

The Martech Landscape is a perfect example of this; where 95%+ of the brands it slaps onto an infographic represent the long tail of purchased licenses. Don’t ask me to explain why these brands were funded. That’s not my job, that’s your job!

What is fueling this explosive growth? Great ideas? I'm sure that's it! 🤦🏻

But then we have to explain this. How is it that an exponentially growing list of great ideas is competing for a finite number of seat licenses?

What a waste of resources. These funds could have been better spent solving problems that have yet to be solved. Instead, we go with the tech bros or other one-time successes that never understood why they were successful. They had a good idea, the appropriate motivation, the required skills and determine, at the right time. But how do you repeat that?

Moving on...

My job is to demonstrate up-front that a startup goal is achievable, and as it stands today, there is really only one way to do it…

…and none of your are doing it.

How was that for a cold start? 😁

Are you ready for more?

I’ll Begin With Some Examples

There are several very common problems that are ignored when investment decisions are made, but I will highlight two of them here:

The Market Sizing Conundrum

The Mini-Job Conundrum

Market Sizing

Whether you are a large established brand, or a small startup, a failure to understand the size (and duration) of a market is a critical early mistake. Sure, you know how to take the number of products sold and multiply it times a price.

But that’s an inappropriate way to determine size a market (or frame it).

First, product categories are an unstable way to frame a market - especially one that doesn't exist yet. You can project that a market like this will grow, but we all know they eventually shrink zero. We can be fooled by the fact that when you start at zero, everything beyond that is growth. The problem is that you have no way of knowing when and why that’s going to happen. You’d just be guessing.

Example

The iPod was a brilliant breakthrough that quickly established a $30 billion market size based on the traditional framing and sizing approaches. So, this encouraged Microsoft to blow about $300 million trying to capture their fair share of this market, believing that if they added a few new features and demonstrated integration into the Microsoft ecosystem, there would be a huge payoff.

What actually happened was that the types of content that were being accessed via an iPod was quickly shifting from a file delivery channel to a streaming delivery channel. While Apple enjoyed great success, it was temporary. The iPod (category) platform had run its course.

Apple was ready and waiting with the iPhone (Microsoft offered the Zune - an iPod replacement) , which not only provided a platform for getting thousands of more jobs done, the platform provided a place for streaming content providers to call home (they also called other platforms home, e.g., Android devices, automobile infotainment systems, computers, etc.).

Lessons Learned

Microsoft didn’t understand the market, how to size it, and what the lifespan was

They failed to understand the Job-to-be-Done or the higher context job that would replace it … Apple apparently did.

Mini Jobs

I’ve already established that product categories are the wrong way to frame markets. They are backward looking, and make it impossible to see the future - without a lot guessing. 👀

Yes, there are people in the JTBD world that get this wrong as well. They fail to recognize that the Job they have identified is really just a step in a higher context job, where other steps are already being enabled by other brands (non-traditional competitors). This makes your job a mini-job.

Piecing this higher-context job together into a map makes it clear which direction future solutions will organically migrate towards. Your job is to see this earlier, and solve the problem much faster than anyone else. Let’s take a look at what not to do.

Example

I’m not sure how many years ago it was now, but there was a proliferation of startups that were focused on building parking apps. We all had our smartphones by this time, and when we traveled we needed more than general navigation. We needed to find a parking lot, especially in those urban travel scenarios.

Locating a Parking Lot seemed like a great idea for an app. Whether this was an idea or it was a JTBD framing, people jumped on it. One day, a presentation on Jobs-to-be-Done was given to product managers in San Francisco. The JTBD at the center of the presentation was people getting to a destination (on time).

It mapped out 18 steps, or so, where step 17 was find a parking space. Let’s think of this as a mini-job because clearly, a number of startups were funded based on this gap in the market. What was being presented was a different view of the future. In this view, it was a step in a higher-context job.

At this time, Google Maps and Waze were already a thing that addressed this higher-context job. And the presentation demonstrated how Google had features to address almost every step … except for the parking step.

A young man raised his hand in the Q&A and mentioned that his company was developing a parking app and asked what that step meant for his Startup. The answer?

“Son, when Google adds this feature to their their Maps platform, no one will need you." (not a direct quote, but close)

Not too long after that, this is exactly what Google did. The JTBD model that was presented in this talk had been developed and prioritized in the market years before and predicted everything that subsequently happened around that platform (even the acquisition of Waze).

It was just a matter of time before all the adjacent steps were addressed on a single platform. (which is one of the primary goals of JTBD)

Lessons Learned

Understand that you may be defining your JTBD too narrowly (or viewing the market through a solution)

Also understand that if you don’t frame the market as a JTBD, you would have no way of knowing this in advance.

Let’s move on to what should change in the world of Venture Capital and the concept of PMF

Let’s Do a Comparison

I’m going to compare traditional Product-Market Fit (PMF) concepts with the Jobs-to-be-Done (JTBD) framework, particularly the Outcome-Driven Innovation (ODI) variation - although my version is substantially adapted and modified to work better, faster, and far less expensively; which is why I’m proposing it.

Vetting tools can now be developed so inexpensively that if you do not develop them to assess potential investments, your competitors will.

We'll explore how the JTBD's approach to "Potential Market Fit" (also PMF) can predict market success before significant resources are invested, addressing each point about traditional PMF from a JTBD perspective.

Key Concept: JTBD Market Definition

In JTBD, markets are defined differently from traditional approaches. Instead of demographic or product-based definitions, JTBD defines markets based on the "job" end users or beneficiaries are trying to get done. This definition supports a more stable innovation perspective over time, as jobs tend to remain consistent even as technologies and solutions evolve.

Comparison Points

1. Market Approach

PMF View: Emphasizes identifying large existing markets with current needs.

JTBD Counter-argument:

Defines markets by jobs-to-be-done, not existing product categories.

JTBD fundamentally redefines how we conceptualize markets. Instead of segmenting markets based on product categories or demographic characteristics, JTBD focuses on the underlying job that customers are trying to accomplish. This shift in perspective allows companies to identify opportunities that transcend traditional market boundaries.

For example, instead of seeing a market for "smartphones," JTBD might identify a market for "communicating with others while on the go." And this is only one market that a smartphone platform can enable (e.g., tasks on the go, scheduling on the go, news on the go, music on the go, etc.). This job-centric definition opens up possibilities for innovative solutions that may not fit neatly into existing product categories but directly address the core customer need.

Allows identification of unmet or underserved needs before product development.

By focusing on jobs-to-be-done and their associated success measures, JTBD enables companies to systematically uncover needs that current solutions aren't adequately addressing. This process doesn't require the existence of a product; instead, it involves deeply understanding the job and mapping out all the success measures customers strive to satisfy when getting that job done.

Companies can then assess how well existing solutions satisfy these outcomes, revealing gaps and opportunities. This approach allows for a more precise identification of market needs before any resources are invested in product development, significantly reducing the risk of creating a product that doesn't fit the market.

Can uncover niche opportunities or create new markets by focusing on underserved jobs.

The JTBD approach excels at revealing overlooked or underappreciated customer needs. By breaking down jobs into detailed success measures and assessing their importance and current effort levels, companies can identify niche segments where customer needs are poorly served.

These niches might be too small or too specific to be apparent in traditional market analyses, but they can offer significant opportunities for targeted innovation.

Moreover, by addressing jobs in entirely new ways, companies can potentially create entirely new markets. For instance, the job of "sharing moments with friends" led to the creation of social media platforms, an industry that didn't exist before but now represents billions in value.

Provides a more stable basis for innovation, as jobs remain consistent over time.

One of the most powerful aspects of JTBD is its focus on jobs that remain relatively stable over long periods, even as technologies and solutions evolve. While products and features may become obsolete, the fundamental jobs customers are trying to get done tend to endure.

For example, the job of "preserving memories" has existed for centuries, even as the solutions have evolved from paintings to photographs to digital albums. By anchoring innovation efforts to these enduring jobs, companies can develop long-term strategies that remain relevant despite technological changes.

This stability allows for more consistent and focused innovation efforts, reducing the risk of being blindsided by market shifts or technological disruptions.

2. Customer Understanding

PMF View: Advocates understanding target audience through interviews about current experiences.

JTBD Counter-argument:

Focuses on underlying jobs customers are trying to accomplish, not just current solutions.

JTBD shifts the focus of customer research from current products or features to the fundamental goals customers are trying to achieve. This approach involves in-depth exploration of why customers use certain products or services, uncovering the higher-level objectives driving their behavior.

For instance, instead of asking customers about their satisfaction with a particular lawn mower, JTBD would explore the broader job of "maintaining an attractive yard." This shift in focus allows companies to understand customer motivations at a more insightful level, providing insights that aren't tied to any specific solution and thus opening up more innovative possibilities for addressing customer needs.

Note: JTBD is also quite handy at evaluating processes and journeys so even a lawn mower manufacture that doesn’t currently express interest in break through innovations can leverage it for an advantage over other lawn mower manufacturers.

Tired of doing the same customer journey workshops over and over again, and never seeing the desired long-term results? I have a solution for you. #jtbd

This is 100% free. However, it does require you to rewire your brains 🤯

Reveals opportunities customers might not articulate when discussing existing products.

Traditional market research often limits customer feedback to the context of existing products or known solution categories. In contrast, JTBD's focus on jobs and success measures allows customers to express needs and desires they might not have considered in the context of current solutions.

By asking about the broader job and all its associated success measures, JTBD can uncover latent needs or frustrations that customers have learned to tolerate or work around. These insights can lead to breakthrough innovations that address problems customers didn't even realize could be solved differently, potentially leading to products with much stronger market fit.

Enables prediction of Potential Market Fit (PMF) for innovative solutions by focusing on desired outcomes.

By prioritizing customer success measures, JTBD provides a framework for predicting the potential success of new solutions before they're developed. Companies can quantify the importance of various outcomes to end user, buyers, and beneficiaries, and assess how well current solutions satisfy these metrics.

This data-driven approach allows for the identification of high-importance, high-effort outcomes, which represent the most promising opportunities for innovation. By developing solutions that directly address these underserved outcomes, companies can predict with greater accuracy which innovations are likely to achieve strong market fit, even if the solution itself is radically different from existing offerings.

3. Measurement Approach

PMF View: Uses post-product surveys like Sean Ellis's PMF survey.

JTBD Counter-argument:

Quantifies importance and effort levels of specific outcomes before product development.

JTBD, particularly adapted from Outcome-Driven Innovation (ODI) universe (where we actually measure sh*t), provides a systematic method for measuring the market potential of ideas before any product development occurs. This involves surveying customers (or highly structured interviews) to rate the importance of various success measures associated with a job, as well as the current effort required to achieve these outcomes.

By quantifying these factors, companies can create a clear, data-driven picture of which aspects of a job are most critical to potential customers and which are currently underserved (it will also tell you where solutions are over-delivering). This quantitative approach allows for more objective decision-making about where to focus innovation efforts, reducing reliance on gut feelings or biased interpretations of qualitative data.

Identifies and prioritizes underserved outcomes to predict Potential Market Fit.

Using the quantified importance and effort data, JTBD practitioners can calculate an "opportunity score" - or better, bottom-up ranking - for each respondent and metric. Success measures with high importance but also high effort (or low satisfaction if you prefer) represent the biggest opportunities for innovation. By prioritizing these underserved outcomes, companies can focus their development efforts on addressing the most pressing customer needs.

This targeted approach increases the likelihood of creating a product with strong market fit, as it directly addresses the areas where customers are most dissatisfied with current solutions. The ability to prioritize opportunities in this way allows companies to allocate resources more effectively and increase their chances of market success.

Reduces risk by assessing market potential without building a product first.

One of the most significant advantages of the JTBD approach is its ability to evaluate market potential without the need for a functional product or even a prototype. By focusing on jobs and outcomes rather than specific solutions, companies can gauge market interest and potential fit before investing heavily in product development.

This approach significantly reduces the risk of wasting resources on products that don't meet market needs. It allows companies to iterate on concepts and value propositions based on solid market data, refining their ideas before committing to full-scale development. This risk reduction is particularly valuable for startups and new product initiatives, where resources are often limited and the cost of failure can be high.

4. Success Metrics

PMF View: Tracks post-launch metrics like user acquisition, retention, and revenue growth.

JTBD Counter-argument:

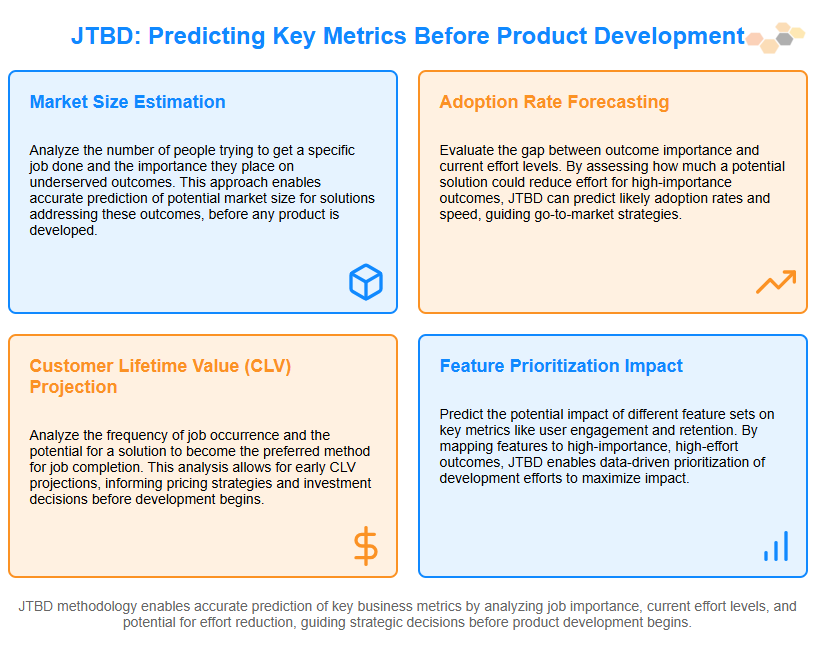

Predicts potential for key metrics before product development.

The JTBD framework, particularly when adapted from the aging Outcome-Driven Innovation (ODI) variation, provides a powerful predictive tool for key business metrics before a product is even developed. By thoroughly analyzing the job-to-be-done and quantifying the importance and effort levels of various outcomes, companies can estimate the potential impact of addressing underserved needs. This approach allows for informed projections of user adoption rates, customer satisfaction levels, and even potential market share.

For instance, if a large portion of the market considers a particular outcome highly important but is very unsatisfied (or high levels of effort) with current solutions, addressing this need effectively (increase in perceived value) could lead to rapid adoption and high satisfaction (or effort reduction) rates. This predictive capability enables companies and investors to make more informed decisions about which opportunities to pursue and how to allocate resources, significantly reducing the risk associated with new product development.

Estimates user acquisition, retention, and value creation potential based on outcome importance and satisfaction levels.

JTBD provides a framework for estimating key business metrics by leveraging the quantified data on outcome importance and effort (or traditionally satisfaction). For user acquisition, the number of people who rate an outcome as highly important but are currently unsatisfied, or currently expend a great deal of effort, can indicate the potential size of the early adopter market. Combining this with Willingness to Pay and frequency information about getting the job done is also a critical factor in market sizing.

Retention can be estimated by considering how comprehensively a proposed solution addresses the full set of important outcomes associated with a job – the more outcomes addressed, the higher the potential for strong retention.

Value creation potential can be assessed by examining the gap between importance and effort across all success measures.

Larger gaps suggest greater potential for value creation, as customers are likely to be willing to pay more for solutions that significantly improve their ability to achieve important, underserved outcomes.

By basing these estimates on concrete data about customer needs, JTBD provides a more reliable foundation for projecting business success than traditional market research methods.

Guides product development and go-to-market strategies proactively.

The insights gained from a JTBD analysis can profoundly shape both product development and go-to-market strategies. On the product development side, understanding the full spectrum of success measures associated with a job allows teams to prioritize features and capabilities that address the most important and underserved needs. This focused approach can lead to more streamlined development cycles and products that resonate more strongly with target customers.

For go-to-market strategies, JTBD insights can inform messaging and positioning by highlighting the specific outcomes that matter most to customers. Marketing efforts can be tailored to emphasize how the product helps customers achieve these critical outcomes, potentially leading to more effective and efficient customer acquisition.

Additionally, understanding the job-to-be-done can guide decisions about distribution channels, pricing strategies, and customer support models, ensuring that the entire customer experience is aligned with helping users get their job done more effectively.

5. Development Process

PMF View: Emphasizes post-launch iterations based on market feedback.

JTBD Counter-argument:

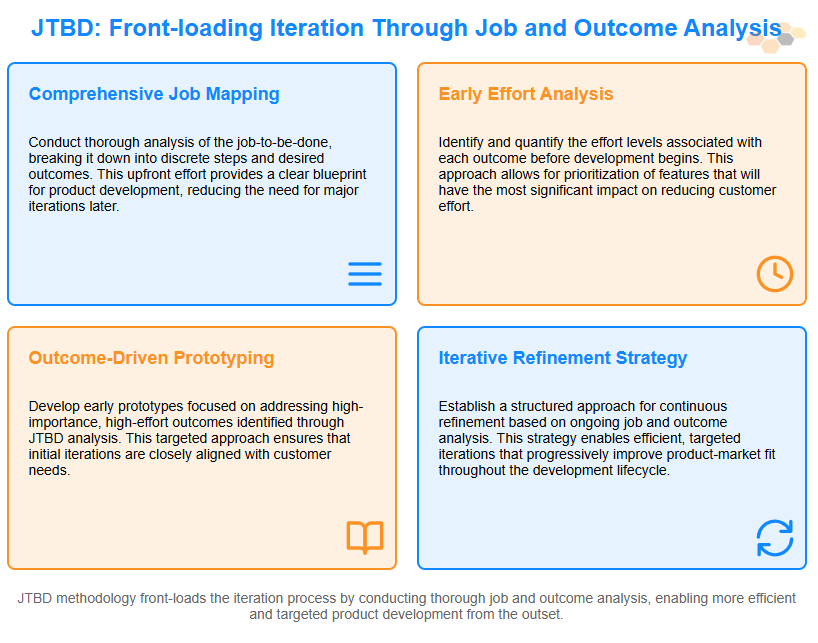

Front-loads the iteration process through thorough job and outcome analysis.

JTBD fundamentally shifts the product development process by emphasizing extensive upfront research and analysis of customer jobs and desired outcomes. This approach contrasts with traditional methods that often rely on rapid prototyping and iterative testing of product concepts.

By investing time and resources in thoroughly understanding the job-to-be-done before any product development begins, companies can significantly reduce the number of iterations required to achieve market fit. This front-loaded process involves comprehensive customer interviews, quantitative surveys to assess outcome importance and satisfaction, and detailed analysis of the competitive landscape – all through the lens of the job-to-be-done.

The resulting insights provide a clear roadmap for innovation, allowing development teams to make more informed decisions from the outset and reducing the likelihood of pursuing unproductive directions.

Minimizes need for major pivots by aligning product closely with job-to-be-done before development.

One of the key advantages of the JTBD approach is its ability to minimize the need for major pivots during the product development process. By gaining a deep understanding of the job customers are trying to get done and the outcomes they're seeking, companies can align their product concepts much more closely with actual market needs from the very beginning. This alignment reduces the risk of developing features or capabilities that don't resonate with potential customers, which often necessitate significant pivots later in the development cycle.

Instead, the JTBD approach allows for more nuanced and targeted iterations, focusing on refining and optimizing a product that is already fundamentally aligned with customer needs. This can lead to faster time-to-market and more efficient use of development resources, as teams spend less time backtracking or completely rethinking their approach.

Provides a stable foundation for product development, potentially reducing time-to-market and costs.

The comprehensive understanding of customer needs provided by JTBD creates a stable foundation for the entire product development process. This stability comes from anchoring development decisions in enduring customer jobs rather than fleeting preferences or technologies.

With a clear, prioritized list of customer outcomes to address, development teams can work more efficiently, focusing their efforts on the features and capabilities that will deliver the most value to customers. This focused approach can significantly reduce time-to-market by eliminating much of the guesswork and misdirected effort that often plagues product development.

Additionally, by reducing the need for major pivots and minimizing the development of unnecessary features, JTBD can lead to substantial cost savings throughout the development process. The result is a more streamlined, efficient path to creating products that have a higher likelihood of achieving strong market fit.

"Failing Fast is for people who failed statistics. The odds of success are the same every time" ~Ulwick

6. Launch Perspective

PMF View: Acknowledges that product launch doesn't automatically signify PMF.

JTBD Counter-argument:

Establishes Potential Market Fit through job and outcome analysis before launch.

JTBD's approach to establishing Potential Market Fit fundamentally differs from traditional PMF methods by focusing on pre-launch analysis and prediction. Through rigorous job and outcome analysis, companies can gain a deep understanding of customer needs and market opportunities before investing heavily in product development or launch preparations.

This analysis involves identifying the core job customers are trying to get done, breaking it down into specific success measures, and quantifying the importance and current effort (satisfaction) levels for each outcome. By doing so, companies can identify underserved areas of the market and assess the potential impact of addressing these needs.

This data-driven approach allows for a more accurate prediction of how well a proposed solution will fit the market, providing a solid foundation for launch decisions and strategies.

Increases likelihood of success at launch by aligning product closely with market needs.

By using JTBD to establish Potential Market Fit before launch, companies significantly increase their chances of success when the product does go to market. This increased likelihood of success stems from the close alignment between the product's capabilities and the actual needs of the target market.

Rather than launching a product and hoping it resonates with customers, companies using JTBD launch with a clear understanding of which customer needs they're addressing and why these needs are important. This alignment allows for more targeted marketing messages, more effective sales strategies, and potentially faster adoption rates.

Additionally, because the product is designed to address specific, validated customer needs, it's more likely to deliver value from day one, leading to higher customer satisfaction and potentially stronger word-of-mouth promotion.

Reduces risk of building products that don't meet market needs.

One of the most significant benefits of the JTBD approach is its ability to reduce the risk of developing and launching products that fail to meet market needs. By focusing on jobs and outcomes rather than specific product features or technologies, JTBD helps companies avoid the common pitfall of creating solutions in search of a problem.

The comprehensive analysis of customer needs and market opportunities that precedes product development ensures that resources are invested in addressing real, validated market needs. This approach significantly reduces the risk of launching products that customers don't want or need, which can lead to costly failures and wasted resources.

Instead, JTBD increases the odds of launching products that deliver meaningful value to customers, enhancing the company's chances of market success and providing a stronger return on investment.

7. Growth Interpretation

PMF View: Recognizes that rapid growth doesn't always indicate sustainable PMF.

JTBD Counter-argument:

Focuses on core jobs and outcomes to predict sustainable Potential Market Fit.

The JTBD framework provides a more nuanced and potentially more reliable approach to interpreting growth than traditional PMF methods. Instead of focusing solely on short-term growth metrics, JTBD emphasizes understanding the core jobs customers are trying to accomplish and the outcomes they seek.

This focus allows companies to predict sustainable Potential Market Fit by aligning their products with enduring customer needs rather than temporary trends or artificial growth drivers.

By thoroughly analyzing these jobs and outcomes, companies can identify which aspects of their product truly resonate with customers' fundamental needs. This understanding helps differentiate between growth that stems from addressing core customer jobs effectively (which is likely to be sustainable) and growth driven by factors like aggressive marketing or temporary market conditions (which may not be sustainable in the long term).

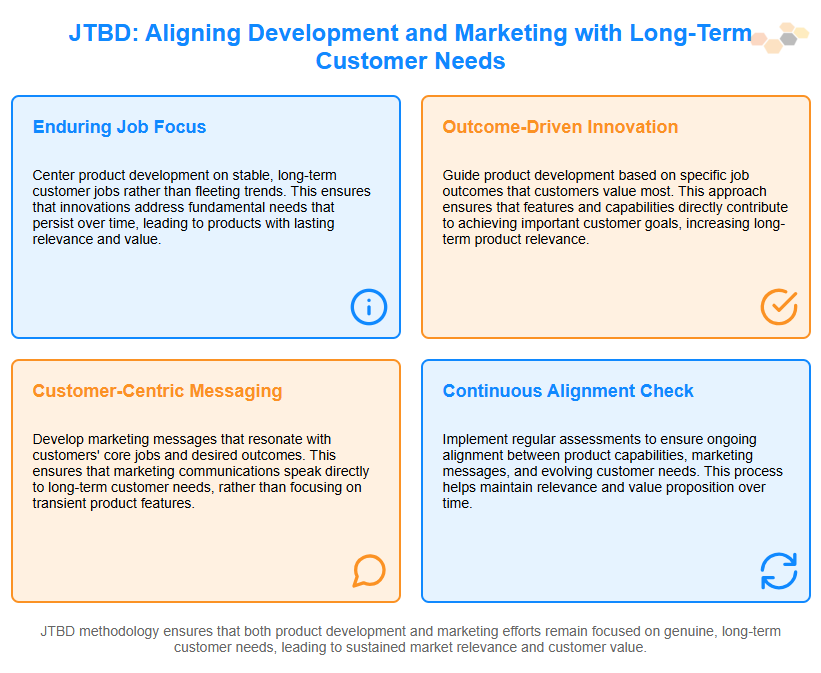

Helps ensure product development and marketing align with genuine, long-term customer needs.

JTBD's emphasis on core jobs and outcomes provides a stable foundation for both product development and marketing efforts. In product development, this approach ensures that features and improvements are prioritized based on their ability to help customers achieve important outcomes more effectively.

Rather than chasing fleeting market trends or competitor features, development teams can focus on innovations that directly address underserved aspects of the customer's job-to-be-done.

Similarly, in marketing, JTBD insights allow for messaging and positioning that speaks directly to customers' fundamental needs and motivations. This alignment between product capabilities, marketing messages, and customer needs creates a powerful synergy that can drive more sustainable growth. It helps attract customers who are genuinely served by the product, leading to higher satisfaction, better retention, and more organic growth through positive word-of-mouth.

Avoids chasing short-term growth at the expense of sustainable market fit.

One of the key advantages of the JTBD approach in growth interpretation is its ability to help companies avoid the pitfall of prioritizing short-term growth over long-term sustainability. In the traditional PMF model, there's often pressure to demonstrate rapid growth, which can lead to strategies that boost numbers quickly but don't necessarily build a stable customer base.

These might include unsustainable discount strategies, over-aggressive marketing spend, or adding flashy but ultimately unnecessary features.

JTBD, on the other hand, encourages a more measured approach. By focusing on how well the product helps customers accomplish their jobs and achieve desired outcomes, companies can assess whether their growth is built on a solid foundation of customer value.

This perspective helps leaders make more balanced decisions, potentially foregoing some short-term growth opportunities in favor of building a product and market position that can sustain growth over the long term.

8. Market Dynamics

PMF View: Sees PMF as requiring ongoing adaptation to market shifts.

JTBD Counter-argument:

Provides a more stable framework for ongoing market analysis.

JTBD offers a uniquely stable framework for analyzing market dynamics over time. Unlike traditional market segmentation methods that often rely on demographic data or product categories – which can shift rapidly – JTBD focuses on the fundamental jobs customers are trying to get done.

These jobs tend to be much more stable over time, even as the means of accomplishing them evolve with technology and societal changes. For example, the job of "staying connected with loved ones" has remained constant for centuries, even as the solutions have evolved from letters to phone calls to video chats.

This stability in the underlying jobs provides a consistent lens through which to view market changes. It allows companies to track how well different solutions are serving these enduring needs over time, providing a more meaningful and actionable view of market dynamics than simply tracking product sales or market share.

Focuses on enduring jobs-to-be-done, which change less frequently than specific solutions.

One of the most powerful aspects of JTBD in understanding market dynamics is its focus on jobs that remain relatively constant over long periods. While specific products or technologies may come and go, the underlying jobs customers need to get done tend to persist. This focus on enduring jobs provides a more reliable foundation for long-term strategy and innovation. It allows companies to anticipate market shifts by understanding how new technologies or solutions might better address these persistent jobs.

For instance, a company focused on the job of "capturing and sharing memories" would be better positioned to navigate the shift from film photography to digital and then to smartphone cameras and social media sharing.

By keeping the focus on the job rather than any specific solution, companies can remain agile and responsive to technological changes while maintaining a consistent strategic direction.

Enables maintenance of Potential Market Fit by continually reassessing outcome importance and satisfaction.

JTBD provides a framework for maintaining Potential Market Fit over time through continuous reassessment of customer needs. This involves regularly measuring the importance of various outcomes associated with a job and how well current solutions (including the company's own products) satisfy these success measures.

By tracking these metrics over time, companies can identify shifts in customer priorities or areas where satisfaction is declining. This ongoing assessment allows for proactive adjustments to products or strategies to maintain strong market fit.

For example, if certain outcomes become more important to customers over time, the company can prioritize improvements in these areas. Similarly, if satisfaction with certain outcomes starts to decline (perhaps due to new competitive offerings), the company can focus innovation efforts on these areas to maintain their market position.

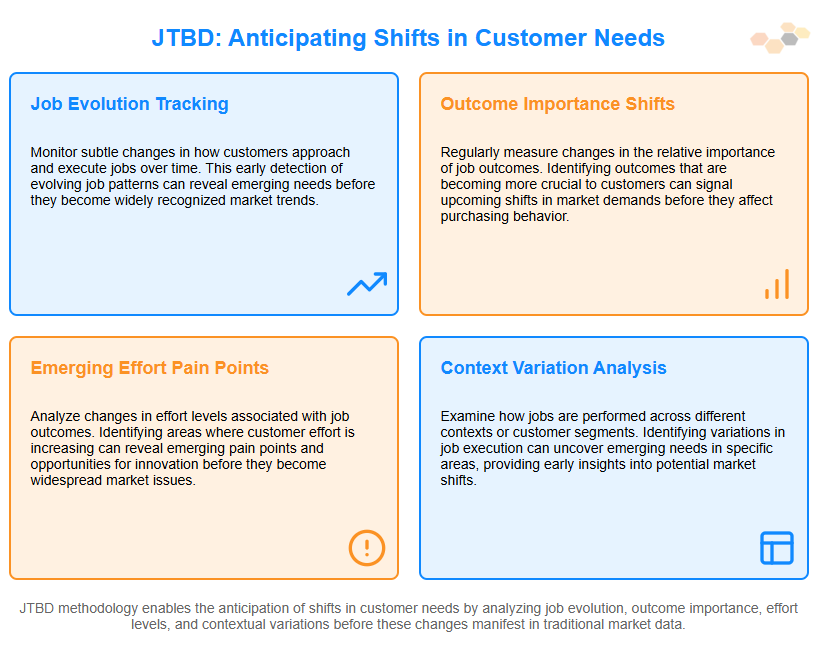

Anticipates shifts in customer needs before they manifest in market data.

One of the most valuable aspects of JTBD in navigating market dynamics is its potential to anticipate shifts in customer needs before they become apparent in traditional market data. By maintaining a deep understanding of the job customers are trying to get done and regularly assessing the full spectrum of associated outcomes, companies can often detect subtle shifts in customer priorities or emerging unmet needs before they significantly impact purchasing behavior.

This early warning system allows companies to be proactive rather than reactive in their approach to market changes. For instance, a company might notice increasing importance ratings for outcomes related to privacy or data security before these concerns translate into changes in purchasing patterns. This foresight enables companies to get ahead of market trends, potentially developing solutions to emerging needs before competitors even recognize the shift is occurring.

The JTBD framework offers a proactive and predictive approach to establishing Potential Market Fit. By defining markets based on jobs-to-be-done and focusing on outcomes rather than existing products or traditional market segments, JTBD allows for:

More informed decisions before significant resource investment. Simple and affordable market models can be pre-baked for quick deal vetting and/or redirection.

Identification of innovative solutions / business models that may create new markets.

Reduced risk in product development and marketing.

A higher likelihood of sustainable success through alignment with enduring customer jobs.

This approach provides a stable foundation for innovation and vetting investments into founder-proclaimed innovations while still accommodating the need for ongoing market analysis and product refinement.

To Founders: We all have ideas. Yours are no better than anyone else's if you're just guessing. It takes more than a set of ‘rules of thumb’ to validate an idea. Open your minds to a far more predictable approach. We've made it faster, less expensive, and generally more accessible. You can succeed, and succeed again.

To Venture Capitalists: You've got it made. No sense upsetting the apple cart, right? 💰💰Just kidding! Or am I? 👀

What I'm doing to make this more accessible

Jobs-to-be-Done, done right, is not a workshop or a handful of customer interviews. It is a rigorous research methodology that has traditionally taken months, sometimes 6 months, to complete for a single, tightly focused study. I realized early on that clients I’ve worked with are competing for growth and they want answers now…not 6 months from now. And it doesn’t matter the size of the company, or the industry.

They also want answers that don’t cost as much. Traditional strategy firms are constantly under downward pricing pressure. Why? Because it’s becoming more and more obvious that the differentiators between them are limited to …

a prettier PowerPoint deck

more energy in their presentations

stronger personalities

better network

As a systems thinker, I’ve long wanted to make this process accessible to companies that don’t have Fortune 500 budgets. Within the past two years, I’ve been able to eliminate well over 50% of the time and cost required to get this work done, and I’m taking steps to reduce the time and cost even more with my global network of collaborators.

At the same time, I can craft more consistent and scalable models than the old-school practitioners. Additionally, I’ve weeded out 99% of the bias that they introduce - which may have turned you off in the past. Yes, that’s actually a thing.

We talk about Jobs, Steps, Success Metrics, Situational Factors, Financial Metrics and more. These make up the model that we prioritize in order to gain the forward-looking insights we need. This model building process can now be done in hours, instead of 6-8 weeks. This leaves time to iterate when necessary, whereas before you had to get it right the first time - or you risked having to reinvest the time, and doubling or tripling your budget!

This approach is scalable for both your investment decision-making process, as well as industry and sector focus.

I know many of you have heard of JTBD. But you’ve heard the lite version of it which is rooted in marketing, not front-end of innovation. The lite version is 100% lagging indicator theater, and 0% forward-looking systems thinking. I’d like an opportunity to expose you to a different way and would enjoy talking to anyone that is interested in helping to propel this approach forward.

It could be your differentiator, especially if your a smaller firm that struggles to get it right with limited funds to invest.

If you’re with a larger firm, wouldn’t it be nice to have 8 hits out of 10 … instead of 1 hit (maybe) out of 60?

If you'd like to learn more...

I do offer end-to-end consulting if you’re just not ready to do it all your own. I’m 20x faster and at least 10x cheaper than your alternatives. Big Brands: This means you can get many more problems solved with your existing budget (I work with a global team of experienced practitioners)

I also offer coaching, if you’d like to know someone’s got your back and you want to do the heavy lifting and get some knowledge transfer, I'm there!

I’ve also offered the Ultimate JTDB Masterclass where you can find an evolving set of GenAI prompts intertwined with an expanding and much deeper look at executing these projects from end to end yourself.

Finally, I've recently opened up a JTBD community that is completely FREE!

www.pjtbd.com | mike@pjtbd.com

Share this post