The theater of marketing

It’s easy to get consumed with whatever your boss tells you to do, right?

We need chatbots because XYZ company has chatbots!

We need AI!

We need to send another email to our mailing list!

We need to run more ads because we have a Google Ads account!

We need to enrich our contact data because we have contacts and there are services that enrich that data!

We need to capture more information from suspects and prospects even if they don’t want to give it to us!

We need to track anyone who visits one of our properties so we can confirm that they didn’t do what we wanted them to do!

There is a critical mass that develops as we watch our peers and competitors do things and we assume that we should be doing them to. Analyst firms fuel this further by telling companies what everyone else is going to do next year. This might explain why the CRM industry has been growing leaps and bounds. We’ve been told to engage more because more is more, right?

Is that helping us to more consistently reach our objectives?

If we begin look at this problem as a solution-independent process, we can understand where the CRM industry is not serving their customers adequately. We will also see where we might offer the right kind of more. This isn’t a take-down…it’s a hopeful wake-up call.

Eastman-Kodak poo poo’d their own invention (digital photography) and continued down the path that had always been profitable for them, until someone else came up with something better. The true customer job was discovered, and the new solutions got more of the job done on a single platform.

Meetings as a Process

We are all familiar with meetings. When we have them, one thing we seem to be obsessed with is the communication technology for meetings, especially these days where remote workers and teams are becoming the norm. But, what if you looked at meetings as a process? Let’s see how communication technology and venues help to support the process.

Anyone who has run (a successful) meeting has addressed each of these areas (steps, and bullets) in one way or another. The meeting itself isn’t the goal, the purpose of the meeting is. Yet, some solution providers insist that they will make your meeting more successful by providing better audio quality, whiteboard technology, or the ability to see people and their expressions. They are focused on limited portions of meeting execution, not achieving the ultimate purpose of the meeting.

I won’t argue that there are performance metrics that meeting organizers use to measure success that relate to remote communication. However, none of solutions available today address the entire process of holding a meeting. In fact, none of the collaboration platforms I’ve seen facilitate meetings in a complete way either; and a meeting is simply one form of collaboration. If there were a solution that digitalized all of these things into a single platform, wouldn’t we all benefit from that? Wouldn’t we love that?

Does Zoom do that?

I’ve actually studied meetings, so I could go much deeper into this topic; but I only bring it up to show you that most solutions either focus on the execution stages of an objective, or they integrate poorly with an array of solutions/methods that deal with earlier and later stages.

Hammers are focused on driving nails into wood, not planning the construction project. Cars, on the other hand, used to be a platform for moving people around, but they didn’t plan the trip, monitor it, or a analyze it very well. Now, through integration, your vehicle can actually do more of those things…it gets more of the job done on a single platform. And we are definitely paying more for that capability, between the vehicle and that little computer thingy you are constantly looking at. And we do so gladly.

Opportunistic innovators in the CRM space might focus on the areas I’m going to suggest in order to drive their own growth by helping companies, who are trying to develop revenue, get the entire job done…on a single platform.

Let’s Look at Marketing Again

I demonstrated in A Map of the market of Marketing that when you view markets as the objective shared by a certain group of people, everything becomes clearer, and far more stable because this sort of objective doesn’t change. It is necessary to see all of the sub-objectives that lead beaters (I mean Marketers 🤪) must reach to be effective in their role. It provides the proper scope and boundaries needed to successfully innovate in just a small part of the much larger CRM ecosystem (we’ll get to more areas later).

In the exhibit below, I demonstrate this concept with a limited set of the top brands in the Martech / CRM space. While some of them span into the lead conversion (Sales) space, and post sale support, it should be clear that there are opportunities being left on the table from an innovation and growth strategy perspective. They may not be sexy opportunities, but I’m very confident that they would be game changers - even in this small part of the larger CRM ecosystem.

It’s simple to read:

Blank spaces means that the brand does not address the sub-objective as I’ve defined it

A check mark indicates that the brand addresses the sub-objective in some form or fashion.

The cloud symbol is a third-party integration indicator. In the case of Microsoft, LinkedIn addresses the sub-objective. In the case of Salesforce.com, they have dropped Data.com and are working on tighter integrations with their AppExchange partners. The last time I worked with Adobe, there were connectors to CRM platforms.

To reiterate, the check marks do not indicate that these brands address the objectives completely, or even adequately. They simply mean that an attempt is made to address it in some way. All by itself, that demonstrates quite clearly where market objectives are not being addressed on a qualitative basis only.

We can extend the depth of the qualitative analysis by taking a look at the performance metrics for each sub-objective to learn whether a brand addresses each of those. I’ve highlighted a few examples below. I don’t want to be didactic here, so I won’t get into how the are developed, or showcase an entire set. The point is this: we can map brands to the metrics to get a better understanding about how completely they address each of the sub-objectives.

Sometimes you don’t even need to run a survey to learn things. However, if we need to understand where brands are over-delivering (cost, complexity), or to what degree a sub-objective is being under-served, a survey will be required. That would also allow us to segment this market based on metrics (the true customer needs), and find groups of marketers who struggle differently when trying to develop qualified leads. These sub-groups will perform the job in similar circumstances and/or with similar solutions.

They have the same job, they just struggle differently. They have different unmet needs from the other groups performing the same job.

Sub-objective: Introduce the offering to prospects (currently addressed)

While many of the brands seem (on the surface) to do a pretty good job addressing the execution steps, there are still metrics which have a heavy reliance on data that might be gathered in earlier, unaddressed, steps. Waiting to gather behavioral data during ineffective marketing interactions is wasteful and the subsequent analysis assumes the prospect’s intent is known (“it must be one of the options we offered!”).

Take this one for example:

Minimize the time needed to determine which contact pathway(s) to offer a prospect during the first interaction

Is this something you’d like to know in advance? Do any of these brands help you to make this decision? Would getting it right the first time, every time, give you an advantage? Is your preliminary testing constrained by your intent and not the prospect’s intent. Is there information you could cull from an earlier step that is more predictive, understands prospects’ intent, is less biased, and less iterative, than A/B testing?

How could a better solution help you with that?

Many of the metrics for this step are being addressed to one degree or another (we don’t know that yet). Therefore I gave it a check. But, do the solutions today make the right choices on contact method in advance (e.g. first time/every time)?

Now, I’ll show you why some of the sub-objectives didn’t get a check mark at all…

Sub-objective: Select a Target Audience to Pursue (not addressed)

Reminder: I define the target audience as a market segment, and the needs of this segment are inputs into product development (well be before developing leads begins).

How do we identify valuable segments to pursue?

Minimize the time needed to quantify the value a target audience offers the business, e.g., market-share gain, profit-share gain, etc.

Does Adobe do this? Does HubSpot do this? Don’t you need to do this? Or does another competency within your organization do this with some other tool or method? This is important information to know. Assuming the product development decision was based on this and other data, you are going to be held accountable for hitting these targets.

It’s good to know what you’re aiming for!

Sub-objective: Understand the Target Audience (not addressed)

Here are a few of the metrics used to measure success at this step in the process.

Minimize the time needed to identify all of the key roles in the target audience, e.g., beneficiaries, purchase influencers, overseers, etc.

Minimize the time needed to quantify a key role’s share of influence over the target audience, e.g., frequency of involvement, number of relationships, etc.

Minimize the time needed to quantify a key role’s level of influence over the target audience, e.g., perceived capabilities, perceived credibility, proximity to decision-makers, etc.

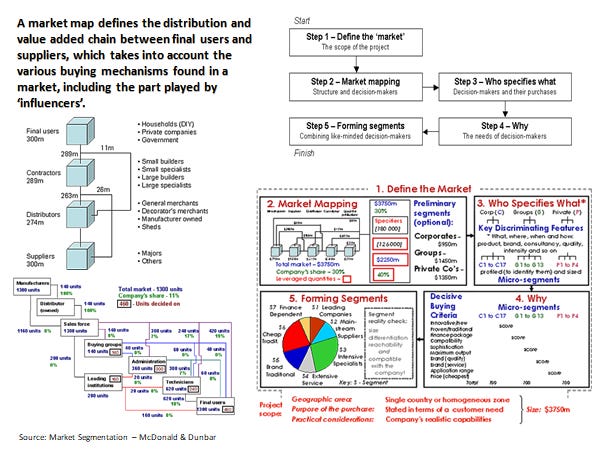

Last time I read Market Segmentation by MacDonald and Dunbar I wasn’t able to map their method to any known brand in the Martech Stack. Perhaps that’s changed. I wrote about it here, but here’s a picture that will help make my point.

While this isn’t the type of segmentation that I talk about related to the target audience, it’s the kind you use to find pathways that are likely to have the most impact, or return on marketing investment. It’s micro-segmentation. There are others like Dan McDade who implement these concepts in their own way. As far as I know none of the CRM platforms do the planning and analysis for these professionals.

Do any of the brands that are commonly used to execute marketing campaigns help you to do this sort of planning and analysis? It sure seems like a great opportunity to get more of the marketing job done, successfully, on a single digital platform!

It seems pretty clear. These platforms focus on objectives related to execution, and typically involve communication, monitoring, and some form of lagging-analysis. Current solutions do have ways to configure complex multi-media, multi-touch, and multi-cycle nurturing, but they don’t help you plan it. Some of you may not bother to use these sophisticated features, and I’d want to know that in a survey. I might also ask some questions about the metrics to which the respondent is held accountable (e.g., lead volume, cost per lead, or lead quality).

The real questions is whether your down-stream customer is happy with the result of your efforts, but that’ll have to be left for a separate study.

Sometimes digital transformation automates processes to help consumers make decisions on their own. Other times, it means putting tools in place that orchestrate a combination of digital and human touch points at key points in the prospect’s decision-making process. How do these systems help marketers to figure these combinations out, and do they figure them out the first time, or the nth time? Which would you prefer?

My purpose in this post is not to deeply analyze each product, we have an entire industry of analysts trying to do that. My purpose is to provide a different model for them to analyze the brands/products against. We go through a lot of machinations when trying to analyze participants in a volatile technology landscape against each other. End users, buyers and industry analysts have cognitive biases related to these variables, and sometimes use confusing, or emerging language.

In a nutshell, we need a constant model that we analyze solutions against, and we need to stop trying to evaluate solutions against each other. How do you know either choice will help you reach your ultimate objective? It might be a better idea to use a model that depicts perfect performance against the objectives that a customer is trying to achieve, even though it’s doubtful anyone will ever achieve that distinction.

In closing…

The meeting process I shared clearly demonstrates that planning solutions/methods lack tight integration into the execution phase. The same seems to be true for marketing solutions. In some cases objectives are addressed by providing standard integration points that facilitate the sharing of information between portfolio products, or between products and third parties. In other cases, they simply fail to address the objective at all.

I used to believe that customer-centricity involved seeing corporate processes through the eyes of the customer, and then eliminating non-value adding activities. Now I know that it really means that we need to see the world through the lens of our customers’ ultimate objectives and strive to develop solutions that help reach the objective with a single solution, or tightly integrated portfolio of solutions. Understanding the scope of their objective(s) is critical.

If we continue to focus our efforts on improving features - sending emails better, and tracking interactions across channels better, - then we miss the larger scope of our customers’ common objective; which means we over-deliver in convenient areas, and in doing so add complexity and cost where none has been demanded. In the future, minimum viable products might be designed with the entire objective in mind (see User Story Mapping). The execution can be good enough (to start) if we’re addressing the entire spectrum of customer success.

If you’d like to learn more about the tools I use to help companies innovate in a differentiated and predictable way, you might enjoy my other newsletters, Zero Pivot Product Planning.🔽

Please leave your comments below!

Share this post